The Weekly Anthropocene Interviews: Sam Butler-Sloss of the Rocky Mountain Institute

An Exclusive The Weekly Anthropocene Interview

The Rocky Mountain Institute (RMI) is a legendary sustainability, clean energy, and energy efficiency think tank that since the 1980s has been one of the major sources of quality research on renewable energy and emissions reduction. Sam Butler-Sloss (pictured above) is a current Senior Associate at the Rocky Mountain Institute, contributing to research on the global energy transition. In this exclusive interview with The Weekly Anthropocene, Mr. Butler-Sloss lends his expert perspective on the present and future of clean, renewable energy.

In the interview below, this writer’s questions and comments are in bold, Mr. Butler-Sloss’ words are in regular text, and extra clarification (links, etc) added after the interview are in bold italics or footnotes. Unless indicated otherwise, charts below are from RMI’s “The Energy Transition Narrative.”

So, what are the immediate prospects for the global energy transition?

Maybe it’s helpful to step back and frame how we [at RMI] see the energy transition. The way we see it is concerns for climate and energy security have sparked a technological revolution.

This revolution is well and truly underway, and gaining more speed and momentum by the day. At the core of this transition is four technologies: solar, wind, batteries, and electrolyzers. Solar and wind are the new source of energy, they provide cheap, abundant, green electrons. Batteries store the electrons. And electrolyzers enable us to make green hydrogen, which will go in the nooks and crannies of the global energy system where direct electrification does not reach. What’s most interesting about these four energy technologies is that they’re growing rapidly and their costs are falling fast, far faster than almost any analysts in the world predicted.

The costs of solar and batteries have fallen by over 80% this decade, wind around 60%, electrolyzers 50%. In one sector after another, they’ve fallen below their fossil fuel competitors in cost. And there’s this body of literature on these falling costs and these learning curves, and they find that these learning curves are very sticky. This relationship between falling costs and volume tends to persist through time. If you take the current trend of these technologies, we expect $15 a megawatt solar by 2030. $1 dollar per kilogram of hydrogen by 2030. The point is, this creates an entirely new energy paradigm, and really changes what’s possible.

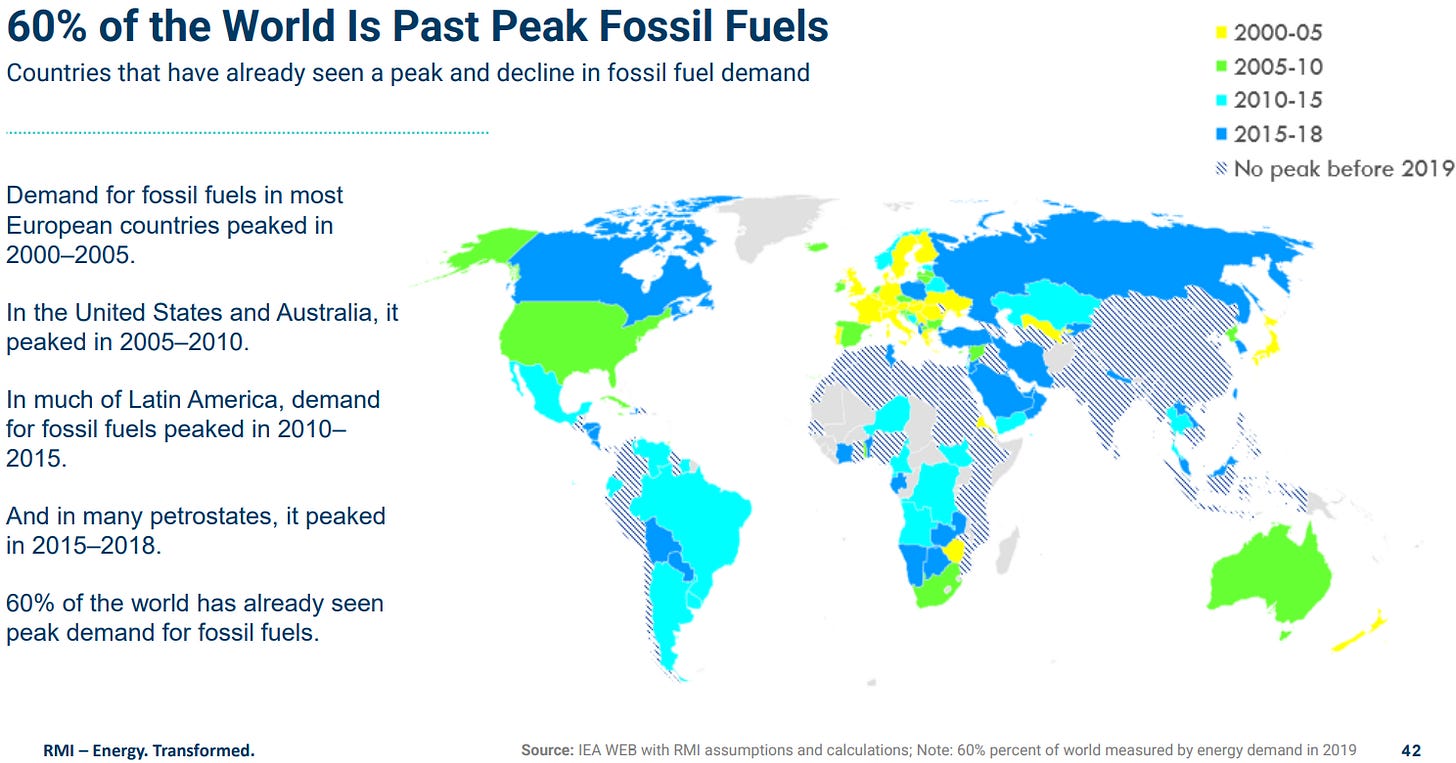

And so the rise of the new is inextricably leading to the decline of the old. Fossil fuel demand is peaking all around us. Fossil fuel demand peaked in the OECD in 2007. And global peak fossil fuel demand was 2019.

Fossil fuels are being squeezed from both sides by efficiency and renewables [reducing demand and replacing supply]. And the math is simple: you have solar and wind now making up 5% of the global energy system and they’re growing at about 20% per year. A 20% growth rate on 5% is equal to new demand growth of 1% of the system. And that’s about global energy demand growth. And solar and wind are getting bigger, growing on S-curves. Within just a few years, with the continued growth rates, it will be more than enough to meet new demand and go into existing levels of fuel demand. First you reach a peak, you bump along a plateau, and with time and effort the new solution climbs up this S-curve, and then it gets to a size where it can really push the old into terminal decline. And speaking globally, we now find ourselves on that plateau.

I should say, this kind of story of a small challenger disrupting a large incumbent has been seen many times throughout history. You have these classic X-shapes of disruption, whether that’s sailing ships to steamships, horses to cars, coal to gas for home heating, gas to electricity in lighting. This kind of story of disruption is not some unusual exception, it is in fact the norm.

In terms of thinking about what it means for the climate, it means that there is much more room for hope than is typically conveyed in many models of our energy future that don’t embrace these cost declines and exponential growth in new energy technology.

And you are beginning to see this change, just last week the IEA published a model seeing fossil fuel demand peaking or plateauing in all their scenarios, which is really a step change in just a few years. (Pictured above: a CarbonBrief chart based on the new IEA outlook that world fossil fuel demand is likely to peak within five years).

From a climate perspective, nothing is fast enough, and every fraction of a degree matters. The forces that are driving this rapid transition are powerful, but that doesn’t take us to the higher ambitions of the Paris Accords. Lots of fossil fuel and business-as-usual voices like to suggest "slow" change is more likely than "fast". A slow change scenario is the least realistic of all, requiring technology and policy to suddenly stop evolving. The only debate is between "fast" or "faster", and it’s key for the climate that we reach that “faster” scenario.

How do you think the Inflation Reduction Act will affect this whole picture of renewables learning curves? And in particular, this bill’s role as part of a broader energy transition competition between the USA and China?

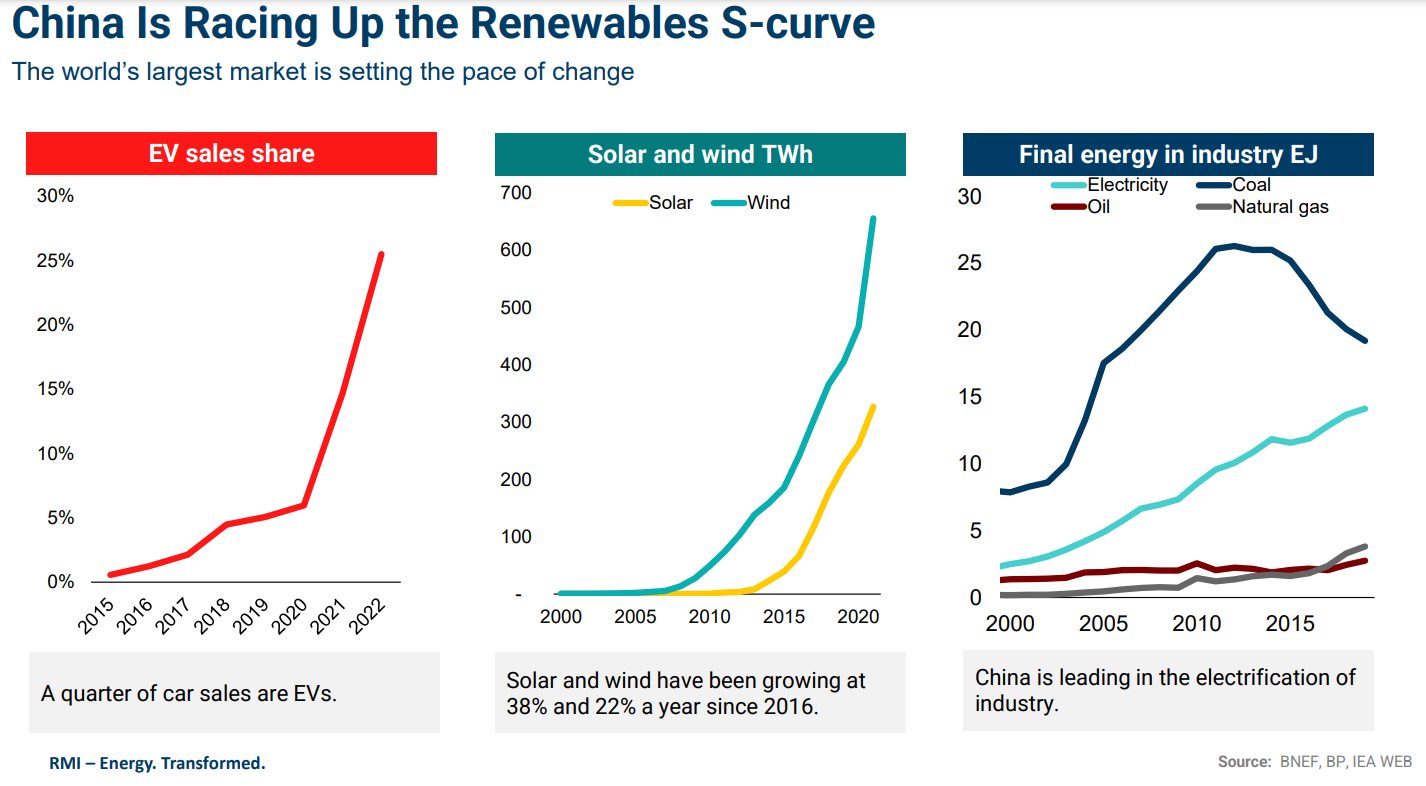

It’s a very good question. So first on the USA and China, I see US-Chinese competition as a real driver of change on the climate front. History shows that technological progress often proceeds from competition for economic and geopolitical leadership. Whether the motivation is climate or not, these are the energy technologies of the future, and there is a strategic imperative to lead this transition and to have domestic supply chains.

As people know, China has been moving very fast. In the latest numbers I saw, China’s share of electric vehicle sales is upwards of 30%, and the US is at 6%. China has a higher growth rate of solar and wind, and dominates the production of these new energy technologies. In rough terms, they have about three-quarters of the supply chain and manufacturing for solar, wind, batteries, and electrolyzers.

What was interesting in the framing of the US bills, all of them, was that the framing of geopolitical security and economic competitiveness were central. I think the net impact is acceleration.

Now to the IRA. It is a big deal, for the US economy and the climate. It moves the US from an energy transition laggard to a player in the global race to the top. The bills will act as a Cambrian explosion for clean energy. Witness people revising their forecasts for solar, wind, battery, and electrolyzer deployment in the US. For example, Rystad Energy estimates that 155 additional gigawatts of new wind and solar capacity will come online by 2030 as a result of the Inflation Reduction Act, over and above the new capacity expected before the Act’s passage!

To state the obvious, localizing supply chains does come at a cost, but there are necessary strategic considerations beyond cost. I think this framing of competition is accelerating change.

What do you think of the attempts at government action to prop up the dying fossil fuels industry (subsidies, US Republicans’ attempts to attack renewables investment and prop up fossil fuels, short-lived UK Prime Minister Liz Truss’ insane attempt to ban solar farms on farmland, etc.)?

I think [this opposition] is increasingly going to be lessened by falling costs and superior technology. As you say, the new technology increasingly has political capital. And of course, the impacts of climate change are moving from models to our real lives. It’s also worth noting that 80% of the world lives in countries that are a net importer of fossil fuels, so for them this is an opportunity to substitute money going to petrostates for local jobs and local opportunities.

What do you think are the prospects for advanced geothermal technologies like EGS and AGS to potentially climb a "learning curve" of their own as a clean source of baseline power?

Well, I think on electricity generation, solar will indeed be dominant globally. It will be the cheapest source of electricity generation all around the world in 2030. Behind solar will be wind. These two technologies will produce most of the world's electricity. That’s based on availability and cost. That’s not saying we don’t need further innovation. And there will be complementary technologies around the edges, fitting countries’ niches, but the winning technologies are clear.

We also know the technology characteristics conducive to learning rates: the simpler, more standardized and granular the technologies are, the more likely they are to exhibit high learning rates. By these criteria solar, batteries, wind and electrolyzers perform well – theoretically and empirically.

What do you think of the prospects for next-generation solar, wind, and batteries technologies like perovskites and iron-air batteries?

Staying one step away from commenting on specific technologies, in the largest part, I tend to see technological change as a dynamic continuum, as opposed to discontinuous breakthroughs. So what’s got solar ridiculously cheap is incremental learning by doing, continuous learning by doing. But listen, there are more minds and money being turned to this, so I would be cautious to make a comment on the ceiling of the possible.

How big of a problem is anti-renewables NIMBY (Not In My Backyard)ism, and how should we overcome it? For example, the construction of the biggest solar farm in the US (in Indiana) is right now under attack from a well-funded extremist group that believes putting solar panels on farmland is an affront to “the way God intended it to be.” That kind of opposition is not going to be responsive to an economic argument.

So, a couple of comments. I think my first comment is the US is especially polarized on this issue, and we wouldn’t want to extrapolate the polarization in the US out to the world. Also, politicians and public leaders need to do a better job at selling the enormous benefits of these new technologies, energy security, jobs, lower bills, public health and so on. To that previous point, I think the cheaper solar and these other technologies get and the better they get, the harder it will be for this opposition to exist. Where this [NIMBYism] is the case, creative solutions will follow. There’s plenty of land available for the solar and renewable future. You can get more creative, you can mandate it on rooftops, over parking lots.

What are your thoughts on how best to source (or reduce the need for) key renewables transition minerals like lithium, cobalt, nickel, and copper? It’s important to note, of course, that moving to renewables means orders of magnitude less mining overall than the current fossil fuel economy, but there still are some serious problems in these minerals’ supply chains, like cobalt in the Democratic Republic of the Congo. There are already efforts to diversify this, there’s a new cobalt mine opening in Idaho, and a potential huge new lithium project in California’s Salton Sea, plus a lot of battery recycling plants. Plus, just announced, a big new lithium mine in France!

I think the framing of your question is very good, and it’s important to note that the material impact of renewable systems on the planet is a hundred times less than fossil fuels. But even with that, we’ve got to diversify supply chains, improve environmental quality of mining, and increase recycling rates. The beauty of these new energy technologies is that they’re recyclable. A lump of coal isn’t. I think that’ll be a key priority area, reaching higher recycling rates.

In fact, I’ve read that battery recycling plants are having a lot of trouble finding enough battery scrap to recycle, since most batteries are pretty new right now.

Yes, not many electric vehicles are coming off the road right now. Each year there are more. That market size of battery recycling just trails behind factory sales by ten years or so.

What are the key remaining pressure points in the global energy system that need to be pushed towards renewables? Where should policymakers act?

The short answer is everything needs to be sped up. There is lots we can do, and lots that is not happening fast enough. On the policy front, there is so much that could be said and can be done. But to give a few examples: it’s critical that we speed up the permitting of solar and wind projects. Set bold targets. Set future bans on key fossil fuel equipment such as gas boilers and internal combustion engines. These redirect expectations and markets.

Internal combustion engine bans have been effective in helping to change the direction of the automobile industry. Something like green hydrogen is much earlier in its S-curve, you need to enable that scaling and those cost reductions to come about sooner through subsidies and industrial hubs.

About hydrogen, I’ve seen some very strong arguments that it’s inherently inferior to electrification due to its extremely low storage density making it very expensive to ship, and a number of other factors. Using hydrogen as a fuel is being heavily pushed by the fossil fuel industry, probably as an attempt to give existing pipeline and tanker ship infrastructure a new liquid fuel to transport so they stay relevant.

Hydrogen is going to have a difficult time competing with direct electrification. It will be quite a small part of the global energy system. There’s some work done by Silvia Madeddu in Europe looking at the potential to electrify industrial heat, and it’s much higher than commonly perceived. Electrification beats hydrogen on efficiency, and efficiency tends to govern the direction of energy systems. I think it will play an important but contained role. What is clear is that we’ve got to decarbonize the 100 million tonnes of fossil fuel hydrogen currently used (mostly in oil production and to produce fertilizers), and that green hydrogen will play a key role in decarbonizing shipping and steel.

Green steel has been very impressive, we’re currently seeing new solar-powered electric arc steel furnaces in Colorado and hydrogen-powered steel manufacturing in Sweden. People were saying that was impossible just a few years ago.

It’s still at an early stage in the S-curve, but you’re right to say that skeptics deemed it impossible, and within a few years, it had been done.

What are your thoughts on how best to communicate to the public an accurate picture of the progress in clean energy technologies? It’s sometimes difficult to avoid collapsing into an oversimplified “doom!” or “everything is awesome!” narrative.

There’s in equal measures no place for despair or complacency. This is going to be difficult, the fossil fuel system is going to resist it and time is very scarce. But a far better future lies within our reach. The economist Paul Romer talked of conditional optimism rather than complacent optimism. He said a child sitting and wishing for a treehouse is complacent. Conditional is when a child gets up, goes to collect materials, and actively pursues it, knowing that with determination it is possible. At RMI we call this applied hope. Applied hope is a stance, not an assessment. A stance to roll up sleeves and focus minds to bring this new energy future forward.

Mr. Butler-Sloss, thank you so much for joining us.

My pleasure.

Great interview. I shared this with a friend who is a long term donor to RMI and he agreed. Thanks.